A Swiss bank account, ready for everything

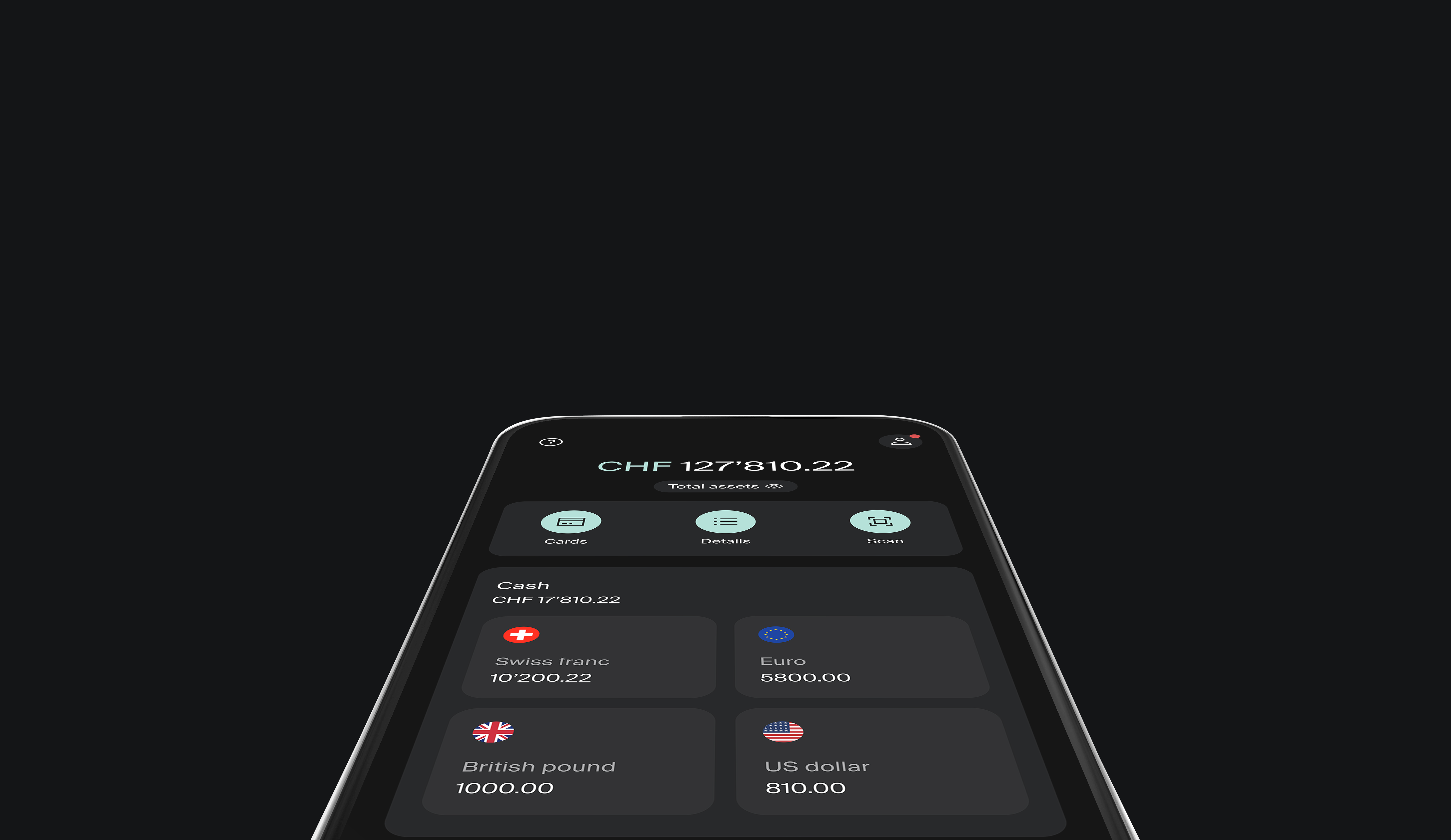

Multi-currency

Enjoy an account with one IBAN in CHF, EUR, GBP, and USD.

Best FX rates

Get exchange rates up to 10x better than traditional banks.

Free of charge

Your Alpian account comes free of charge, with no monthly fees.

Manage your salary

Receive your salary at Alpian and access a Swiss IBAN, QR bill payments, and powerful features to manage your money with ease, at no cost.

All the advantages for your everyday banking

Multi-currency account

Hold CHF, EUR, USD, and GBP to pay and transfer without conversion fees.

Swiss customer service

Get support from our dedicated Swiss-based team whenever you need it.

QR code payment

Settle bills fast by scanning QR codes directly in the app.

TWINT Prepaid

Pay easily online or in-store with TWINT.

Alpian Direct

Send and receive money instantly with other Alpian clients. 24/7.

Apple Pay and Google Pay

Add your Alpian card to your phone and pay with just a tap.

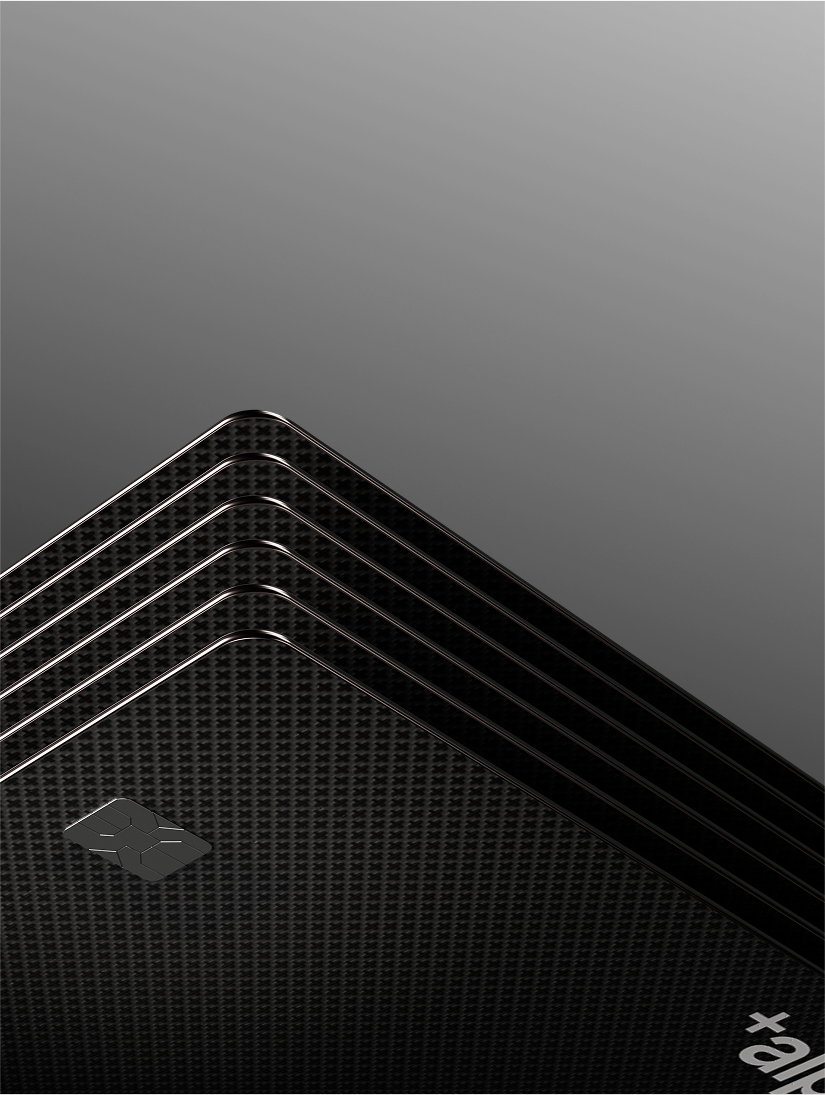

Metal card

A metal card that combines security, style, and four currencies in one.

Virtual cards

Instantly create up to 5 free multicurrency cards for safe shopping worldwide

Savings account

Grow your money and keep your funds accessible.

Spend abroad like a local

Use your Alpian card in 160+ currencies worldwide and access exchange rates up to 10× better than the market.

Please note that currency exchange rates on our website are updated periodically and may not reflect real-time values. For up-to-the-minute rates, refer to our mobile app, where updates occur in real-time. The information provided is for reference only and not intended for trading decisions. Exchange rates may vary, and we cannot guarantee their accuracy at any given time due to potential delays and market changes. By accessing our services, you acknowledge the possibility of discrepancies between displayed and actual transaction rates. We advise users to verify current rates independently before any currency exchange activities. This notice is in accordance with Swiss regulations to ensure user awareness and transparency.

4.5 stars rating on App store

Top 3 Swiss Neobanks

Comparison of costs - Account and card

Bronze award

Neobanks & Fintech Players

A card for every need

Virtual Card

Spend safely and instantly

Metal debit card

As beautiful as secure

American Express

Exclusive bonus points and benefits

Your invitation to next level banking

Join Signature and experience exclusive benefits

Starting is simple

Upgrade your plan

Start for free

Standard

Free account with everything you need for daily banking.

Meet the conditions

Signature

Everything in Standard and access to exclusive benefits.

Interest on EUR & USD

Earn monthly interest on your Euro and USD and access it anytime without limits.

We have more for you

Investment mandates

Start investing from 2'000 CHF with expert advisory, low fees, and a selected ETF portfolio.

Savings account

Grow your money with a flexible account that keeps your funds accessible.

Pillar 3a

Plan your retirement in the best conditions with a 3a solution.

Frequently asked questions

Can I receive my salary at Alpian?

Yes, you can receive your salary directly into your Alpian account.

Simply share your Alpian account details (IBAN and BIC) with your employer. Salaries can be paid into your multicurrency account in CHF, EUR, USD, or GBP, depending on your employment setup.

To find your account details:

Open the Alpian app, go to your Profile section, and tap IBAN to access your document with all your account details, ready to share with your employer.

Your employer can then transfer your salary directly to Alpian, just like with any other Swiss bank.

How do I open an account with Alpian?

To open an account with Alpian, begin by downloading the app, available for both iOS and Android devices. During the sign-up process, you will be asked to provide some personal information and complete a quick ID verification to ensure security and compliance.

Eligibility requirements: You must hold a valid Swiss residence permit and provide an original, valid passport or national ID. Please note that photocopies will not be accepted.

Activating your account: The final step to activate your account involves making a deposit that must come from a bank account registered in your name at a licensed bank located either in Switzerland or a FATF country.

Important: Because of FINMA regulations, deposits from neo-banks and financial platforms that do not hold a banking license such as Neon, PayPal, Revolut, Yuh, or Wise are not accepted.

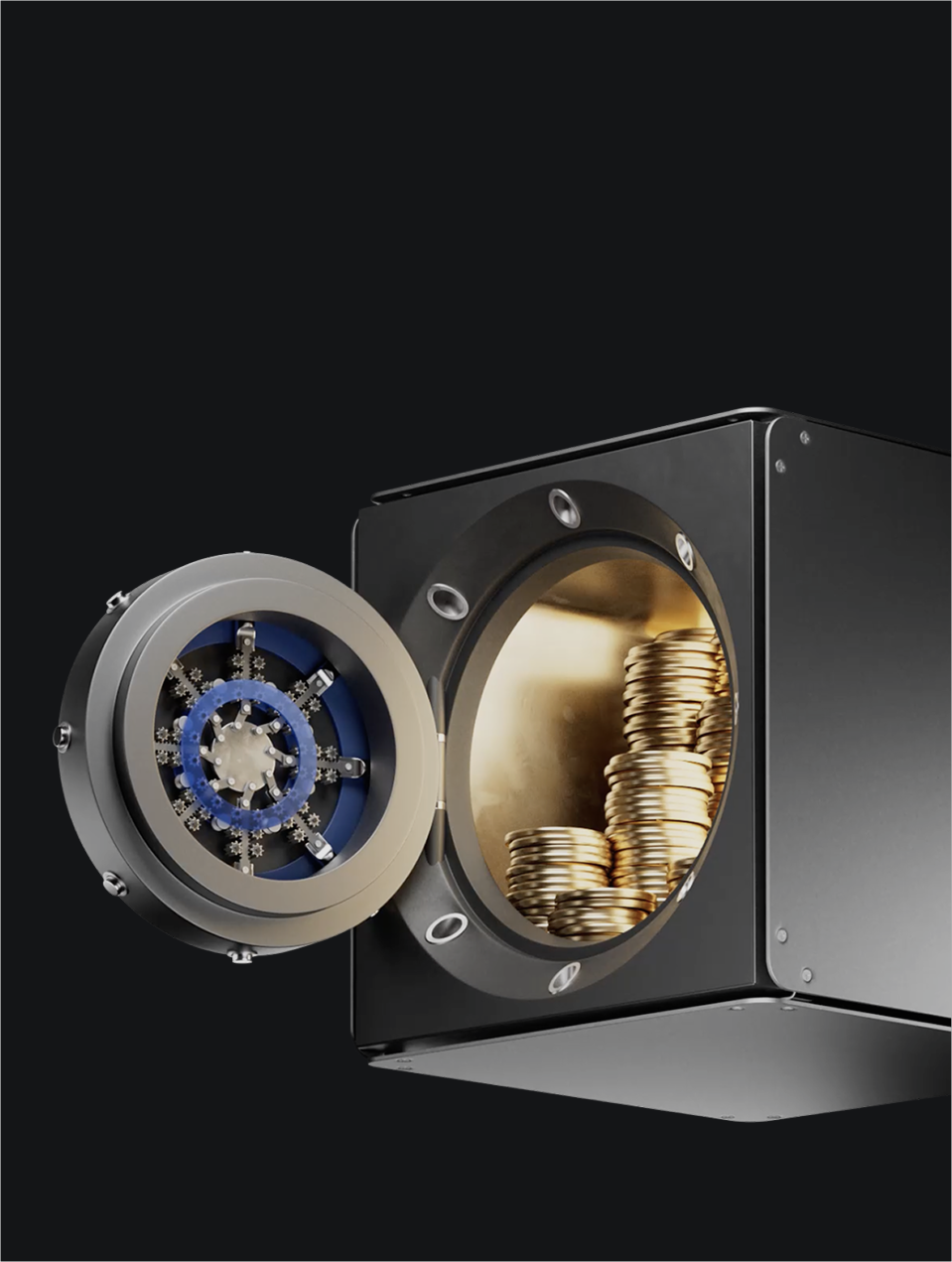

Is my money guaranteed with Alpian?

Yes, your money is protected with Alpian.

Alpian is a fully licensed Swiss bank, regulated by the Swiss Financial Market Supervisory Authority (FINMA). As a Swiss bank, Alpian is a member of the deposit guarantee scheme esisuisse, which protects client deposits up to CHF 100’000 per client in the event of a bank failure.

In addition, Alpian is part of the Intesa Sanpaolo Group, one of Europe’s leading banking groups, reinforcing the security and stability behind our operations.

Your assets and deposits are protected in accordance with Swiss banking regulations, ensuring the same level of security as with any other Swiss bank.

How does the multi-currency account work?

Our multi-currency account allows you to hold the four most commonly used currencies—CHF, EUR, USD, and GBP—under a single IBAN. This feature enables you to hold, transfer, pay, save, and receive money in these currencies without the need for multiple bank accounts.

Funds are credited in the currency they are received in. For example, if you receive 100€, it will be credited and stored in euros. This is perfect for frequent travelers and expats, as it allows you to manage your finances without commissions or high exchange rates.

Can I use TWINT with an Alpian account?

Yes, the pre-paid version of TWINT can be funded through your Alpian account. Please follow the steps below to get started:

Download the prepaid TWINT & other banks application.

Complete the TWINT account opening process.

Once the TWINT account is open and verified, select the Payment option within the TWINT mobile application.

An email will be received from TWINT which includes a QR code with which to make the payment to fund the account.

Login to your Alpian account, navigate to the Cash page, and select Payments.

Select the QR payment option and scan the QR code sent by TWINT.

Once the payment is complete, the TWINT account will be funded and available for use.

)

)

)

)

)

)

)

)

)

)

)