Your savings, always accessible

Accessible

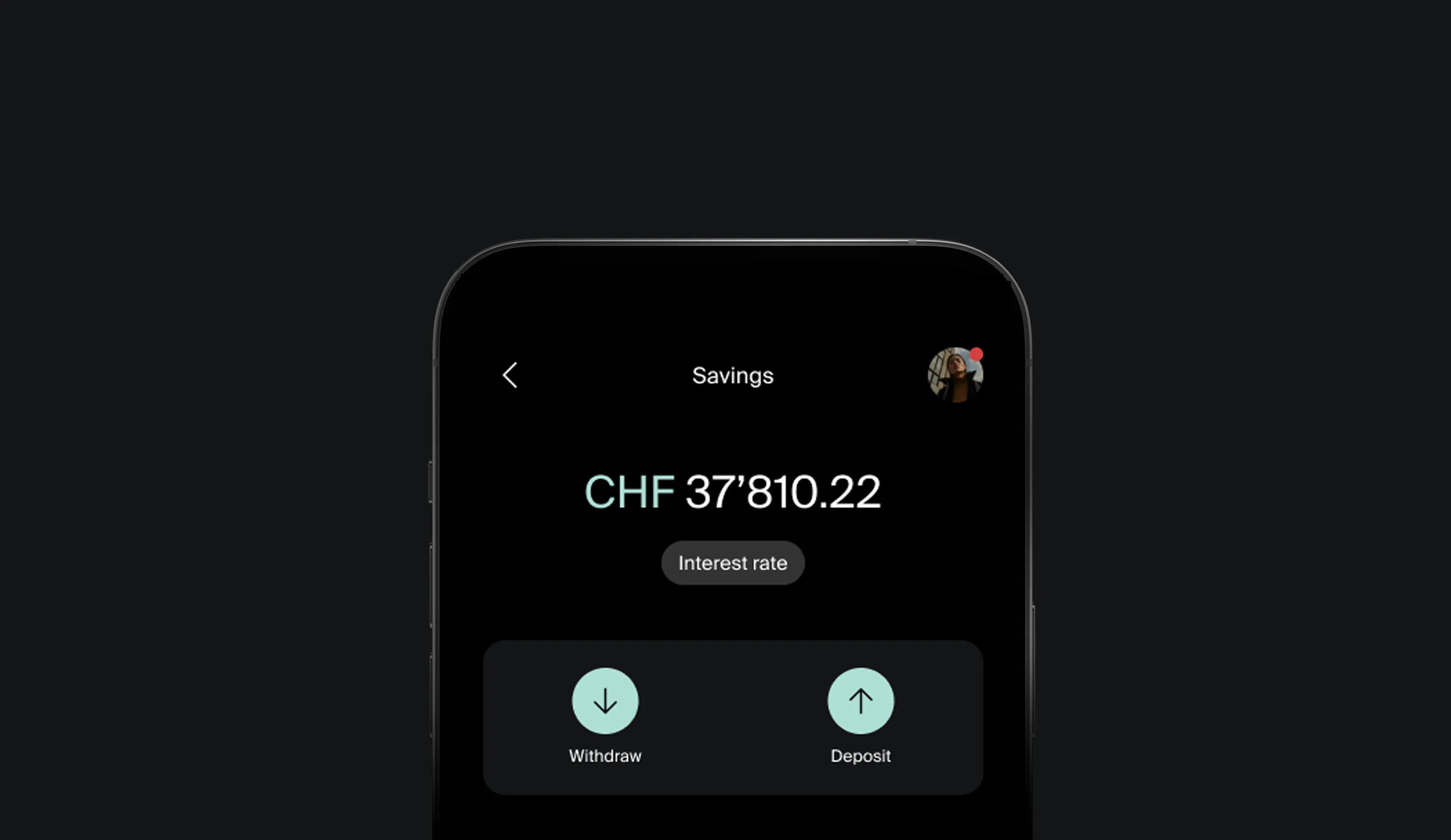

Your savings stay flexible. Withdraw anytime, no penalties.

Earn monthly

Interest is credited every month, calculated annually.

Secure

Grow your savings knowing your deposits are guaranteed.

Save with advantages

Build your emergency fund, earn monthly interest on your CHF savings, and access your money anytime at no cost.

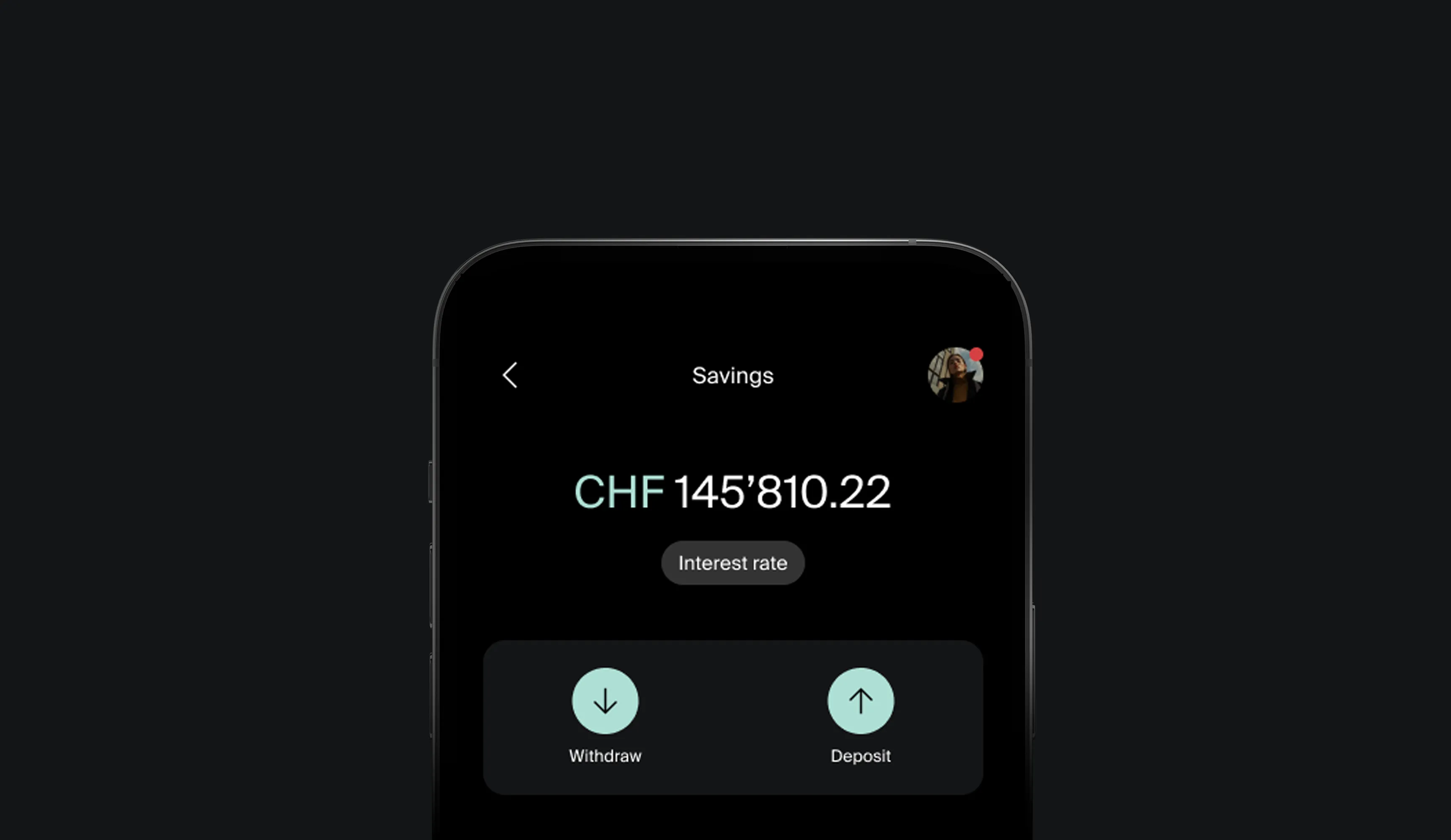

Earn more as your balance grows

The benefits of saving with Alpian

:fill(transparent))

Instant access

Use your money anytime with no restrictions.

:fill(transparent))

Monthly interest

See your savings grow with monthly payouts.

:fill(transparent))

No hidden fees

Your savings account is included with Alpian.

:fill(transparent))

No limits

Save any amount with no maximum cap.

:fill(transparent))

Full freedom

Spend, transfer, or withdraw whenever you choose.

:fill(transparent))

Safe & protected

Your deposits are guaranteed up to CHF 100'000.

Why saving matters

Easily set money aside and stay prepared for the moments that matter most.

Home upgrade

Cover moving costs, deposits and renovations for your future home.

Unexpected expenses

From medical bills to car repairs, savings mean you can act without stress.

Future plans

Travel, family or weddings, everything starts with having funds ready.

Conditions and services

Base interest rates

Earn 0,01% p.a., paid monthly, on your entire balance up to CHF 125'000.

Earn 0,10% p.a., paid monthly, on your entire balance if above CHF 125'000.

Base interest rates are subject to change at Alpian’s discretion and may be adjusted based on changes by the Swiss National Bank.

Availability

Your capital remains fully accessible at all times, with no notice period or fees.

However, if your balance exceeds CHF 125'000 on March 31, 2025, but you withdraw more than CHF 10'000 before the end of the year, the booster will be canceled—only the base rate will apply.

Interest payment

The base interest is paid monthly on a prorated basis.

The booster interest, where applicable, will be paid in full on January 2nd, 2026.

Fees

No fees.

Still have questions?

Are my deposits protected with Alpian?

Yes, your money is protected with Alpian.

Alpian is a fully licensed Swiss bank, regulated by the Swiss Financial Market Supervisory Authority (FINMA). As a Swiss bank, Alpian is a member of the deposit guarantee scheme esisuisse, which protects client deposits up to CHF 100’000 per client in the event of a bank failure.

In addition, Alpian is part of the Intesa Sanpaolo Group, one of Europe’s leading banking groups, reinforcing the security and stability behind our operations.

Your assets and deposits are protected in accordance with Swiss banking regulations, ensuring the same level of security as with any other Swiss bank.

How do I open an account with Alpian?

To open an account with Alpian, begin by downloading the app, available for both iOS and Android devices. During the sign-up process, you will be asked to provide some personal information and complete a quick ID verification to ensure security and compliance.

Eligibility requirements: You must hold a valid Swiss residence permit and provide an original, valid passport or national ID. Please note that photocopies will not be accepted.

Activating your account: The final step to activate your account involves making a deposit that must come from a bank account registered in your name at a licensed bank located either in Switzerland or a FATF country.

Important: Because of FINMA regulations, funds transfers from companies like Revolut, PayPal, or Wise are not accepted.

What is the minimum amount required to open an account at Alpian?

There is no minimum amount required to open an account. However, an initial transaction is necessary to activate the account.

)

)

)

)

:fill(transparent))

:fill(transparent))

:fill(transparent))

:fill(transparent))

:fill(transparent))

:fill(transparent))

)

)

)