The market at a glance: Virtual insanity

This summer is turning out to be hotter than we expected—not in terms of temperature, but in market movements.

From surprising downturns in equities to unexpected gains in bonds and currencies, and a wild ride in cryptocurrencies, the financial landscape is far from calm.

If you're an investor, you're probably wondering what's happening, what's changed, and what to expect. So, without further ado, let's dive into the analysis.

The market at a glance: Virtual insanity

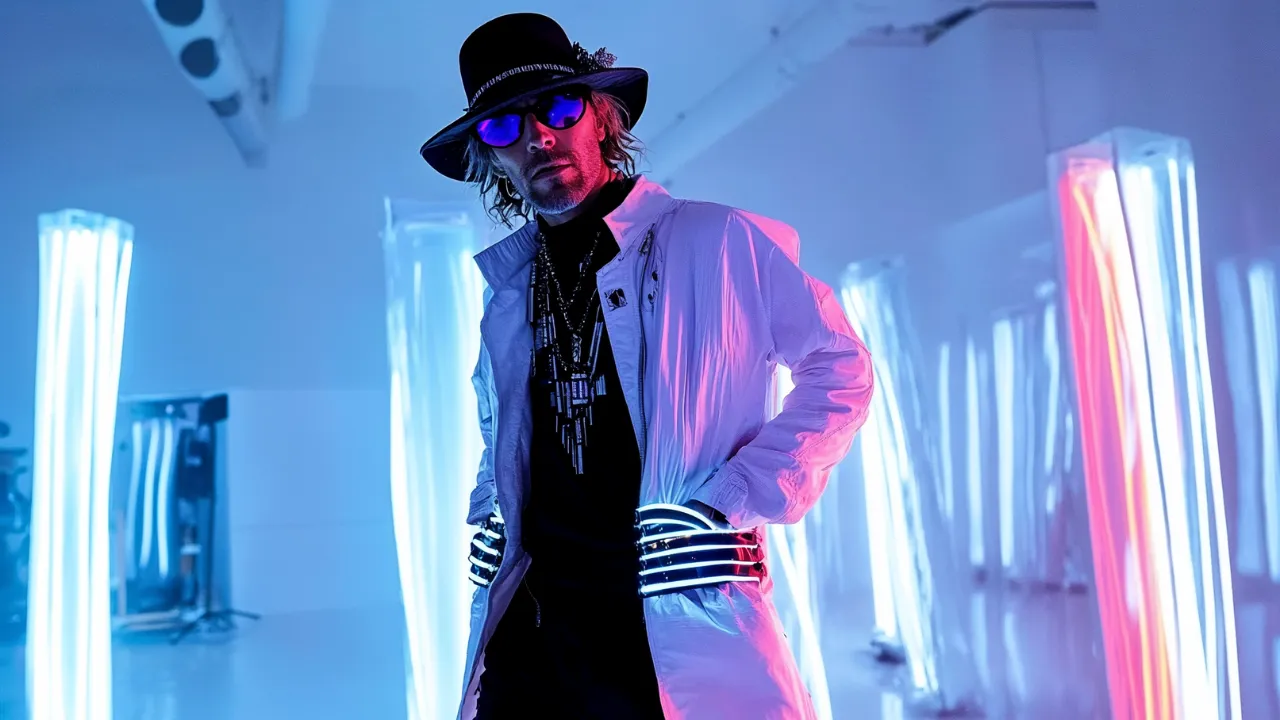

I must say I am a big fan of Jamiroquai. I discovered the English funk band when I was a teenager, and today their songs still set the rhythm for some of my family car rides. What's not to love about them? The groove, the lyrics, the visual effects—they have it all. Some of the social and environmental themes they evoked were quite visionary at the time. The song we picked for this month's edition is one of their biggest hits: "Virtual Insanity," which earned the band a Grammy Award in 1997 and a Guinness World Record for the best-selling funk album in history. The song perfectly describes the current mood in the markets, which nosedived in the second part of July.

Summer is usually a quieter period in financial markets. Fewer participants mean fewer trades and less liquidity, which can sometimes lead to more exacerbated market movements. This is what we saw in July, with the most pronounced drawdowns occurring in one of the most exuberant pockets of the markets: the tech sector.

Many wise investors had raised the alert in previous months, noting that what was happening in the tech sector was virtually insane. Nvidia reaching a $1 trillion market value, AI boosting the S&P, the magnificent seven more magnificent than ever… And now investors find themselves walking on shifting ground like Jay Kay in the "Virtual Insanity" clip.

Is this the beginning of a crash many are predicting, or is it just a temporary setback?

Before answering this question, let's review the recent market action.

Key takeaways

Equity markets took a hit in July, possibly reflecting a reality check on recent rapid growth.

Bond markets strengthened, driven by the prospect of lower interest rates.

Commodities struggled, but gold remained steady.

The Swiss franc appreciated against most currencies.

Cryptocurrencies markets remained volatile; Bitcoin gained political attention, while Ethereum struggled to ride the wave of ETF approval news.

What happened with equities

July started so promisingly. On the 16th, the S&P 500, the leading American stock index, reached a new all-time high, lifting most equity markets worldwide. Even the European markets seemed to be recovering from the post-election hangover.

But then, things turned south. Most indices plummeted to close the month in negative territory. And this trend seems to continue in August.

What was the catalyst? Was it the earnings season that got off to a mixed start? The uncertainty around the upcoming US elections? Some impatience with the central banks’ hesitations? Poorer economic data? Or the realisation that trees don't grow up to the sky, even when powered by AI?

As is often the case with markets, it is pointless to try to find culprits. Saying "It was long overdue" doesn’t add much either. It's better to focus on dealing with the situation. And our degree of comfort with it.

On our side, we introduced protections in our portfolios in May, as we found Investor enthusiasm was a bit excessive for our taste. And in August we took further actions to lower risk in portfolios. This put us in a better position to think about what could come next but we don't have a definite answer.

Could stock markets go lower? Certainly. As we mentioned in the March edition of our newsletter (you can read it here), some pockets of the market are clearly overvalued, especially in the tech sector. The slightest spark, such as a worse-than-expected earnings report or an unexpected piece of news, could easily trigger a sell-off. However, we do not foresee a massive, generalised drawdown at this stage for a couple of reasons:

First, in recent years, we have seen more localised corrections where one sector's decline is offset by gains in another.

Second, as we have noted many times, not all parts of the market are overvalued; some are clearly undervalued. While tech stocks were taking a plunge, we saw out-of-favor sectors making a comeback, such as smaller caps, value stocks, and regional banks.

Finally, if the macroeconomic situation were to deteriorate, central banks could provide some support. So, for now, and until we are proved wrong, we see this correction as an opportunity to shop around.

What happened with bonds

The misfortune of one makes the happiness of others. While equity investors are always chasing "magic spells" and "big things that should be small," to paraphrase Jay Kay, you can always count on bond investors to be down to earth. Inflation, interest rates, and economic data are what set their days.

With central banks lowering rates in Europe and the Federal Reserve expected to follow suit in September, bond prices have gone up and global bond indices are up 1% this month. Consequently, the most conservative portfolios are regaining strength after years of poor returns. That's good news and a good reminder that diversification can prove useful for Investors.

What happened with commodities, currencies, and digital assets

July was not a great month for commodity investors and the first days of August do not bode well. Oil prices declined, industrial metals continued to spiral down, and agricultural commodities reached new lows. Only gold, stimulated by widespread pessimism, gained a few percentage points.

The pessimism also boosted the Swiss Franc against most currencies, which is good news for those who counted on extra spending power during their holidays abroad. Our national currency is true to its reputation as a safe haven (a safe haven is an investment that is expected to retain or increase in value during times of market turbulence), an interesting feature to leverage if the situation in the markets deteriorates further.

Finally, on the digital markets front, the results were mixed. Bitcoin, still enjoying some political attention (some argue it has become a proxy for Donald Trump's advancement in polls), was up 7.4% in July before being hit when markets reversed. Ethereum, on the other hand, struggled despite the launch of several ETFs and decent inflows.

To conclude, July was a rocky month for investors and August started off on a wrong foot. Equity markets declined, and the moves were probably exacerbated by the lack of liquidity. As we mentioned in June, we expected turbulence throughout the summer, but we are not overly concerned at this stage. As long as diversification is our ally and we can count on protection in portfolios, we should be able to navigate the markets. Additionally, corrections always offer opportunities to readjust portfolios.

On this note, we wish you a pleasant rest of the summer. Taking a break is also a way to temporarily leave a world sometimes full of virtual insanities.

Demystification room: What is the impact of elections on the markets?

2024 is a historic election year, with elections taking place in 64 countries. More than 49% of the world's population is expected to head to the polls this year. In July, we had the UK and French elections, and recently, the focus shifted to the US election. So, we want to spend a bit of time discussing a question we are often asked: Do elections impact financial markets in general?

On paper, it is reasonable to suppose that elections can influence financial markets. Politics shape economies through policies, taxes, and spending, which in turn affect investors' views on financial markets. However, this link is often more subtle than we think, making it challenging for investors to take full advantage of it. First, let's debunk two myths:

Myth #1: Markets tend to go up the year before elections

Some people believe the ruling party tends to boost the economy and markets right before an election to gain the favour of voters, but according to a study by Fidelity Research, the data doesn’t support this idea. While it is true that markets often go up in election years, this isn't necessarily because of the elections; it is just that markets, on average, tend to go up.

Myth #2: One party is better than another for market returns

If you look at the US or the UK equity markets over the past 100 years, they have historically averaged positive returns under nearly every party combination—left, right, or divided parliament. In reality, markets are nonpartisan and react more to overall economic conditions. Additionally, because there are dramatic differences between the proposals expressed on the campaign trail and the actual policy changes that take place once the candidate is in office, betting on which sectors will be impacted the most before the elections can be risky.

So, do elections have no impact at all? There seem to be situations where the impact is more pronounced:

The impact of elections tends to be more exacerbated in emerging markets than in developed countries.

Markets tend to react positively to change, so we see higher average returns when there is a change of party in power.

Markets don’t like uncertainty. This is why, for example, the UK market reacted less than the French market this month. Uncertainty around policy implementation, especially policies that affect international relationships, also has significant effects, as seen with Brexit.

Source Fidelity Research. Past performance is no guarantee of future results. Data spans from November 30, 1950, to November 14, 2023. Years represent the 12-month period from November 30 to November 30 following a US presidential or midterm election. The chart depicts the average, minimum, and maximum price return achieved during this period. Stocks are represented by the S&P 500®.

Source Fidelity Research. Past performance is no guarantee of future results. Data spans from November 30, 1950, to November 14, 2023. Years represent the 12-month period from November 30 to November 30 following a US presidential or midterm election. The chart depicts the average, minimum, and maximum price return achieved during this period. Stocks are represented by the S&P 500®.

So, how should investors prepare their portfolios for elections?

The first thing to do is to stick to your strategy. Elections generate a lot of noise, and it's often better to ignore it. Research shows that economic variables like inflation or growth will have a far greater impact on market returns.

The second thing to do is to vote. It is an indirect way to influence the market in the direction you want!

Get a ticket to the Sauvage Music Festival!

At Alpian, we're thrilled to sponsor exciting events across Switzerland. We've partnered with Sauvage Musique, a unique festival featuring live DJs, and have some tickets to give away. To claim your ticket, simply check the different festival dates by clicking the button below.

If you're an Alpian client, get in touch with a bank specialist via the chat and let them know which date you'd like to attend. You can get a ticket just for yourself!

)